how much is capital gains tax on property in florida

250000 of capital gains on real estate if youre single. So if you sold an asset for 1000 that you had.

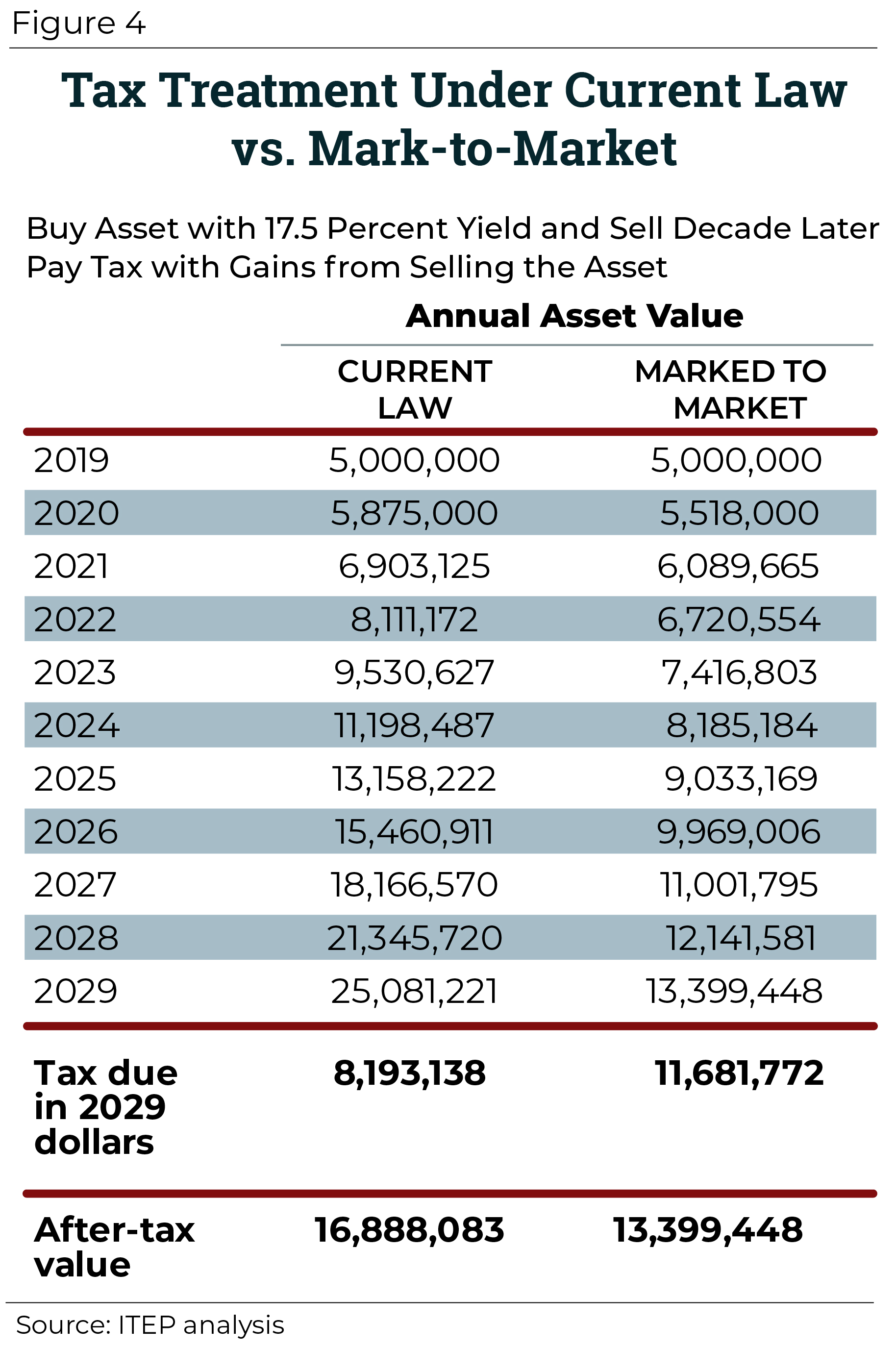

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

You have lived in the home.

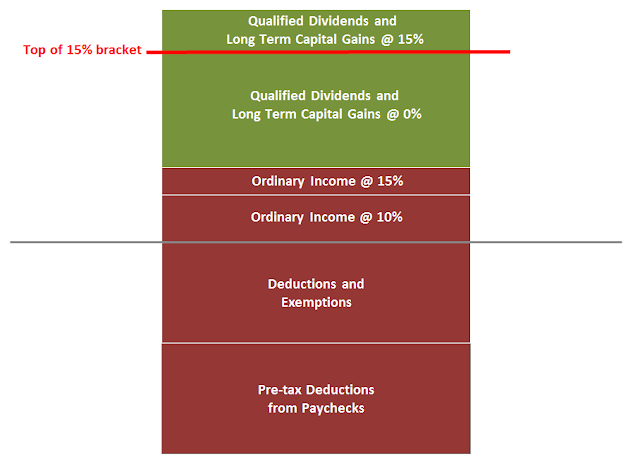

. You can exclude a portion of profits when selling your Florida house via the Capital Gains Tax Exemption. Ncome up to 40400. Most single people will fall into the 15 capital gains rate which applies to incomes between 40401 and 445850.

2022 federal capital gains tax rates. However the general formula for calculating capital gains tax is. What is the capital gains tax rate for 2021 in Florida.

At 22 your capital gains tax on this real estate sale would be 3300. Couples filing jointly pay 10 tax on the first 20550 of their income 12 on income from 20551 to 83550 and so on to a maximum of 37 for income 647850 and. State taxes still apply but may be reduced if the state has a credit or other favorable tax reductions on the sale of a primary residence.

The year of purchase is indicated by the Financial Year 2015 and the year of sale is indicated by the Purchase Year 2011 in the case of 2011 and 2015 financial years. This amount increases to 500000 if youre married. The amount of taxes youre responsible.

Not All Profits Are Taxable. The IRS typically allows you to exclude up to. Capital Gains Tax Exemption.

Florida does not have state or local capital gains taxes. Gains from Section 1250 are taxed at a rate of 25 on the proceeds. If you were to start paying incrementally in November youd save 200 by the time it was paid in full.

From the above example the 63000 is an. 500000 of capital gains on real estate if youre married and filing jointly. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

If you later sell the home for 350000 you only pay capital gains taxes on the 50000 difference between the. Sale Price Purchase Price x Capital Gains Tax Rate. Also if you move to.

15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. At the moment the federal long-term capital gains tax rate is.

Capital Gains rates depend on your income bracket. Federal-level capital gains tax Despite the absence of capital gains tax required by the state Floridians are still subject to federal taxes. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

If you sell the home for that amount then you dont have to pay capital gains taxes. So lets say your property taxes are 5000. 4 rows You used it as your primary residence for at least two of the past five years.

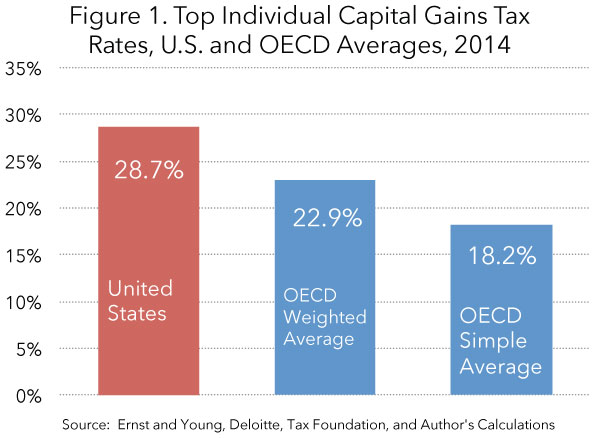

However if you are in the 396 income tax bracket you will pay a 20 capital gains rate on your long-term capital gains. What is capital gains tax on real estate in Florida. 15 for regular Americans 20 for high-earners They also have to pay 38 Medicare surcharge so the total amounts to 238.

For example a single person with a total short-term capital gain of. If you live in a state that taxes income any gains you make on a property will be subject to state taxes. Individuals and families must pay the following capital gains taxes.

As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in Florida. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. The state of Florida does not have a capital gains.

Just like income tax youll pay a tiered tax rate on your capital gains. The highest rate is 20 and the lowest rate is either 0 or 15. The Combined Rate accounts for the Federal capital gains rate the.

The two-year period. Single filers with incomes more than 445851 will.

State Taxes On Capital Gains Center On Budget And Policy Priorities

How To Pay No Capital Gains Tax After Selling Your House

/images/2022/02/04/model_house_sitting_on_money_2.jpg)

5 Brilliant Ways To Avoid Capital Gains Tax On Inherited Property Financebuzz

Tax On Capital Gains While Receiving Social Security Benefits

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Capital Gains Tax Rate 2022 How Much Is It Gobankingrates

Capital Gains Tax On Stocks What You Need To Know The Motley Fool

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Short Term And Long Term Capital Gains Tax Rates By Income

2022 Capital Gains Tax Rates Federal And State The Motley Fool

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

How To Calculate Capital Gains Tax On Real Estate Investment Property

Guide To The Florida Capital Gains Tax Smartasset

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit